Understanding your collision insurance claims policy's towing coverage is crucial for a seamless claims process. Most policies include vehicle transport, roadside assistance, and sometimes storage fees, with varying restrictions on distance and repair facilities. Policyholders should consult their insurer's guidelines before towing, as terms differ. Initiate the claims process by verifying towing coverage and contacting your insurer promptly to obtain a claim number and approved services. Following towing, auto body shops can directly bill the insurance company for efficient reimbursement and vehicle restoration or maintenance.

In the event of a vehicle collision, understanding towing coverage within collision insurance policies can significantly impact out-of-pocket expenses. This article guides you through the process of navigating collision insurance claims, focusing on when towing services are included. We’ll explore eligibility criteria and the steps to file a claim for related expenses, ensuring you’re informed in the event of an accident. Maximize your insurance benefits by knowing when and how to avail of towing assistance.

- Understanding Towing Coverage in Collision Insurance Claims

- When is Towing Included? Eligibility Criteria

- The Process of Filing a Claim for Towing Expenses

Understanding Towing Coverage in Collision Insurance Claims

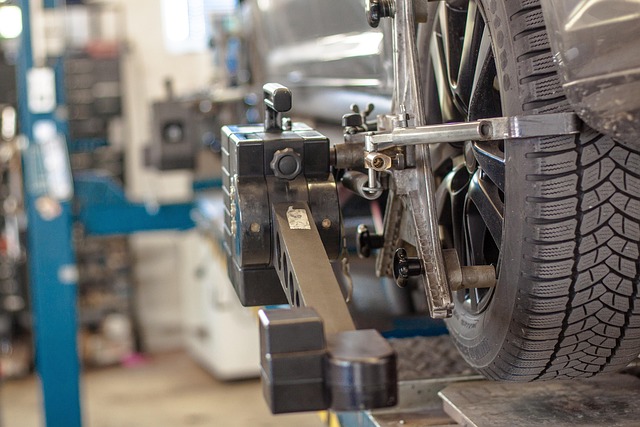

When involved in a collision, understanding your insurance policy’s towing coverage is crucial to ensuring a smooth claims process. Collision insurance claims often include towing services as a standard benefit, designed to facilitate vehicle recovery and repair. This coverage extends beyond simply transporting your damaged car to a repair shop; it can also encompass the cost of roadside assistance and even storage fees in certain instances.

Knowing the specifics of your policy’s towing provisions is essential for maximizing your benefits. While some policies may offer limited towing distance or have restrictions on chosen repair facilities, others could provide more comprehensive coverage, including services like vehicle restoration, auto body painting, and auto bodywork repairs. Familiarizing yourself with these details can help you navigate the claims process efficiently, ensuring that all associated costs are accurately accounted for during your collision insurance claim.

When is Towing Included? Eligibility Criteria

When it comes to collision insurance claims, towing is often included under specific circumstances. To determine if your vehicle can be towed, policyholders should first consult their insurance provider’s guidelines. Typically, towing is covered when a vehicle is deemed unsafe to drive following a collision. This could be due to severe damage to the car body restoration or vehicle bodywork, making it unsuitable for road travel.

Eligibility criteria may also include proximity to a repair facility. If the nearest qualified mechanic is far away, insurance companies might cover the cost of towing to ensure the vehicle receives prompt car collision repair. However, not all policies offer this benefit, and terms can vary, so policyholders should review their collision insurance claims coverage thoroughly before initiating any towing services.

The Process of Filing a Claim for Towing Expenses

When you’re involved in a collision, navigating the process of filing a claim for towing expenses can seem daunting, but understanding the steps involved will help streamline the experience. The first step is to ensure that your collision insurance policy covers towing costs. Many policies do include this coverage as part of their benefits, especially when the vehicle is severely damaged and needs to be towed from the accident site.

Once you’ve confirmed coverage, contact your insurance provider promptly. They will typically assign a claim number, which you should keep handy when interacting with the towing company. The insurer may also provide a list of approved or preferred towing services, ensuring that the charges are covered up to the policy’s limits. After the vehicle is towed, the auto body shop can file for reimbursement directly with the insurance company, simplifying the process for everyone involved and facilitating the car’s eventual restoration or auto maintenance as needed.

In conclusion, understanding when towing is included in collision insurance claims can significantly alleviate financial burdens during challenging times. By familiarizing yourself with eligibility criteria and the claim filing process, you can effectively navigate this aspect of collision insurance. Remember that thorough knowledge empowers you to make informed decisions and ensure a smoother recovery process for your vehicle and related expenses.