Collision insurance claims are vital for driver financial security, offering prompt compensation after accidents. Filing involves reporting incidents, providing detailed information, and submitting required documents. Proper documentation, including photos, videos, witness statements, and repair estimates, is key to swift claim resolution. Understanding the process and avoiding common mistakes, like independent claim handling, can simplify repairs and settlements. Reputable vehicle services can aid in accurate documentation and dispute prevention.

Collision insurance claims are an essential aspect of vehicle ownership, providing financial protection against unforeseen accidents. This article guides you through the key elements required for a valid claim, offering insights into the process and best practices. We’ll explore the fundamentals, from understanding policy coverage to effective documentation. Learn how to navigate potential pitfalls and ensure your claim is processed smoothly. Master the art of collision insurance claims management for a stress-free experience.

- Understanding the Basics of Collision Insurance Claims

- Documenting and Proving Your Claim Effectively

- Navigating the Claims Process and Common Pitfalls to Avoid

Understanding the Basics of Collision Insurance Claims

Collision insurance claims are a crucial aspect of protecting your financial well-being and ensuring prompt compensation during unforeseen vehicle accidents. Understanding the basics of these claims is essential for every driver, as it empowers them to navigate the process efficiently when the need arises. A collision insurance claim involves reporting an incident to your insurance provider, providing detailed information about the accident, and submitting necessary documentation to initiate the reimbursement or settlement process for any resulting damages.

When dealing with a collision, whether it’s a minor fender bender or a more severe crash, knowing what steps to take is vital. The first step is to ensure everyone’s safety by moving vehicles to a safe location if possible and calling emergency services if necessary. Next, exchange insurance information with the other party involved, including their policy details and contact information. Documenting the incident by taking photos of the damage to your vehicle and any visible injuries is also essential. Following these initial steps, individuals can then file a claim with their insurance company, providing them with accurate and comprehensive information about the collision, including witness statements if available. This process facilitates the assessment and approval of repairs or compensation for replacement through the coverage provided by collision insurance policies, which specifically cater to damages incurred during vehicular collisions.

Documenting and Proving Your Claim Effectively

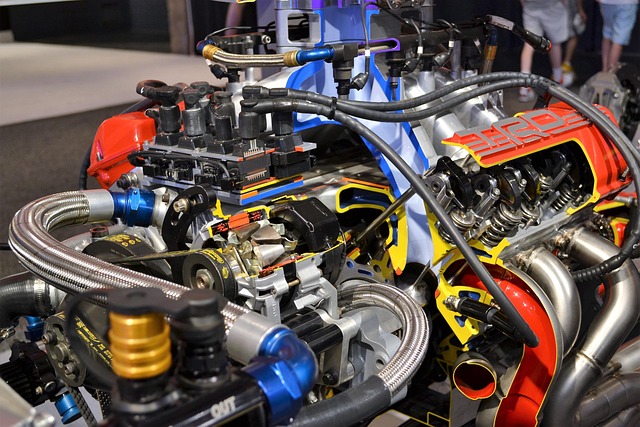

When filing a collision insurance claim, documenting and proving your case effectively is paramount to ensuring a swift and fair resolution. The first step involves capturing detailed evidence of the incident and its aftermath. This includes taking multiple photos of the damaged areas, such as car dent repair or vehicle paint repair, from various angles. Also, record any relevant information like the date, time, location, and details of the other party involved. Video footage, witness statements, and police reports can significantly strengthen your claim.

Additionally, keep records of all repair estimates for both auto glass repair and other significant damages. These documents serve as tangible proof of the extent of the collision’s impact on your vehicle. Organize this evidence in a logical manner to present a clear and compelling case to your insurance provider. Effective documentation can make the difference between a smoothly processed claim and one that faces delays or denials.

Navigating the Claims Process and Common Pitfalls to Avoid

Navigating the claims process for a collision insurance claim can seem daunting, but understanding the steps involved and common pitfalls to avoid is essential. The first step is to notify your insurance provider as soon as possible after the accident, providing them with all relevant details and documentation, including police reports and medical bills if applicable. From there, your insurer will guide you through the rest of the process, which typically includes filing a claim, assessing damage, and arranging for repairs. It’s crucial to keep records of all communications and agreements throughout this period.

One common pitfall to avoid is trying to handle the claim without professional help. Dealing with insurance companies can be intricate, and they often have specific requirements that must be met. Engaging a reputable vehicle body shop or car body restoration service can significantly streamline the process. They understand the claims process and can ensure your auto frame repair or other necessary repairs are accurately documented and accounted for in your claim. This not only saves time but also helps prevent disputes or delays in getting your claim settled.

Collision insurance claims require a thorough understanding of the process and key elements to ensure a smooth and successful outcome. By documenting your claim effectively, gathering all necessary evidence, and navigating the process with care, you can maximize your chances of receiving fair compensation for collision-related damages. Remember, knowledge is power when it comes to collision insurance claims, so be prepared, stay organized, and don’t hesitate to seek professional help if needed.