Before filing a collision insurance claim, understand policy coverage, including deductibles and eligible repairs. Document damage with photos, exchange contact details, and gather relevant documents for faster settlements. Prepare by gathering repair estimates, understanding your policy, and negotiating calmly with factual evidence to ensure cost-effective, high-quality collision repairs.

“Maximizing the benefits of collision insurance claims can significantly ease financial burdens after an accident. This guide offers advanced tips to help you navigate the process effectively. We’ll explore key aspects, starting with a thorough understanding of your collision insurance coverage and the importance of efficient documentation for faster claim processing. Additionally, we provide valuable negotiating strategies to ensure you receive fair compensation. By following these steps, you can confidently manage collision insurance claims.”

- Understanding Collision Insurance Coverage Thoroughly

- Efficient Documentation for Faster Claim Processing

- Negotiating With Insurers: Tips and Strategies for Success

Understanding Collision Insurance Coverage Thoroughly

Before engaging any collision claim services, it’s crucial to understand your collision insurance coverage thoroughly. Collision insurance is designed to cover repairs for damage to your vehicle resulting from accidents, and understanding what’s covered and what isn’t can significantly impact your out-of-pocket expenses. Your policy will dictate things like deductibles, the types of repairs that are eligible for reimbursement, and whether or not rental car services are included during the repair period. Take time to review your policy documents and, if needed, reach out to your insurance provider for clarification.

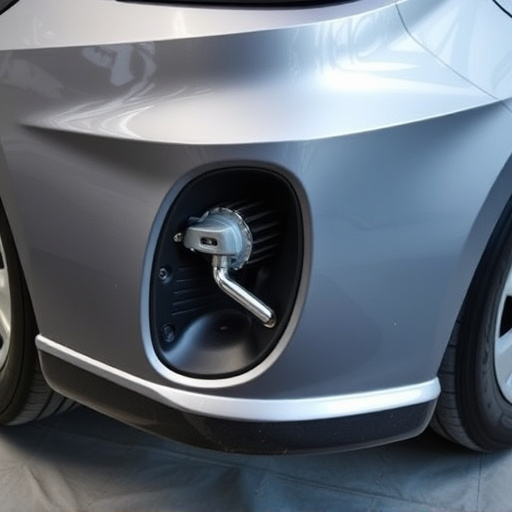

Knowing what constitutes a collision claim is also essential. This typically includes accidents with other vehicles, but it might also cover damage from hitting fixed objects like trees or poles. Once you’ve established that a claim is valid under your policy, consider visiting a reputable collision repair center or auto repair shop to assess the damages and discuss potential solutions. Skilled professionals can guide you through the process, ensuring that your vehicle is restored to its pre-accident condition while adhering to industry standards for car bodywork services.

Efficient Documentation for Faster Claim Processing

Efficient documentation is a key factor in expediting the claim processing for collision insurance claims. When a car collision occurs, it’s essential to capture detailed and accurate information immediately. This includes taking photographs of the damage from various angles, documenting the exchange of contact details with other parties involved, and keeping records of all communications related to the incident. Additionally, gathering relevant documents like vehicle registration, insurance policies, and medical records (if applicable) can significantly streamline the claims process.

Proper documentation not only ensures a smoother journey for both the policyholder and the insurance company but also aids in accurate assessments for car collision repair or automotive restoration. By providing comprehensive information, individuals can anticipate faster settlements and more precise estimates for repairs, including car collision repair services that will restore their vehicle to pre-accident condition.

Negotiating With Insurers: Tips and Strategies for Success

When negotiating with insurers for collision insurance claims, it’s crucial to be prepared and strategic. First, gather all necessary information about your claim—photos of damages, estimates from reputable collision repair shops (including luxury vehicle repair specialists), and any documentation that supports your case. This demonstrates your thoroughness and helps justify your requested repairs or compensation.

Next, understand the ins and outs of insurance policies. Know what your coverage entails and any deductibles applied to your claim. Be prepared to present your case calmly and clearly, providing factual evidence rather than emotional appeals. Consider seeking advice from experienced professionals in paintless dent repair or visiting a reputable collision repair shop for expert guidance. Additionally, remain open to mutually beneficial solutions—like accepting alternative repair methods that are both cost-effective and high quality—which can expedite the claims process.

Collision insurance claims can be streamlined with a few advanced strategies. By thoroughly understanding your coverage, efficiently documenting incidents, and employing effective negotiation tactics, you can navigate the process with confidence. These tips empower you to secure fair compensation for collision-related damages, ensuring a smoother journey towards repair or replacement. Remember, armed with knowledge and preparation, managing collision insurance claims becomes less daunting and more successfully resolved.