Collision insurance claims protect policyholders from financial loss due to vehicle accidents, covering repairs or replacements caused by negligence or unexpected incidents, with exclusions for regular wear and tear or non-accidental damage. To expedite claims, keep detailed records and estimates for repairs like fender or auto body work. Maximize benefits by understanding coverage and circumstances. Document evidence through photos, video, and witness statements. Effective documentation smooths communication with insurers and increases claim success rates. Gathering essential information immediately post-incident, maintaining open communication, and following insurer guidance simplifies the process.

Looking to file a collision insurance claim? Navigating the process can be complex, but understanding key elements ensures a smooth experience. This guide breaks down the essentials of valid collision insurance claims, from comprehending your coverage to effectively documenting and proving your case. We’ll walk you through each step, empowering you to navigate the claims process with confidence. Learn how to maximize your compensation and get the support you deserve after an accident.

- Understanding Collision Insurance Coverage

- Documenting and Proving Your Claim

- Navigating the Claims Process Effectively

Understanding Collision Insurance Coverage

Collision insurance coverage is designed to protect policyholders from financial loss in the event of a vehicle accident. When filing a collision insurance claim, understanding this coverage becomes crucial. This type of insurance typically covers the cost of repairing or replacing your vehicle after a collision, whether it’s due to another driver’s negligence or an unexpected incident like hitting a stationary object.

It’s important to know that collision insurance does not cover regular wear and tear or damage caused by non-accidental events. Therefore, when making a claim, ensure you have a clear understanding of the circumstances leading up to the accident. For instance, if your claim involves repairs for a fender repair, car scratch repair, or auto body work, having detailed records and estimates can expedite the claims process.

Documenting and Proving Your Claim

When filing a collision insurance claim, documenting and proving your case is paramount to ensuring a swift and fair resolution. The first step involves capturing comprehensive evidence of the damage. This can include taking multiple photos from various angles showcasing both the front and rear ends of both vehicles involved in the incident. Clear images of any visible dents, scratches, or other physical deformities are crucial. Additionally, documenting any visible signs of impact zones on the cars’ paintwork is essential for supporting your claim.

Video evidence can also be highly beneficial. A short clip recording the collision from a safe distance can help in reconstructing the event and providing context to the damage incurred. Beyond visual documentation, gathering written statements from witnesses who saw the accident unfold can significantly strengthen your collision insurance claim. These steps are vital when pursuing car scratch repair or car dent repair services through your insurance provider. Effective documenting not only facilitates smoother communication with insurers but also increases the likelihood of a successful claim, ensuring you receive compensation for the necessary car bodywork services.

Navigating the Claims Process Effectively

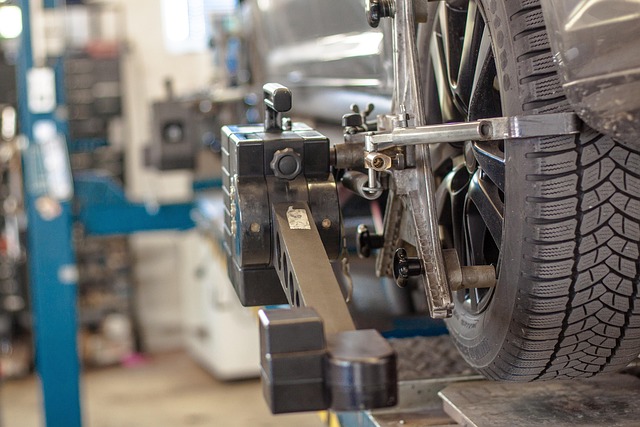

Navigating the claims process for a collision insurance claim can seem daunting, but understanding the key steps can make it smoother. The first step is to ensure all necessary information is gathered promptly after the incident. This includes taking pictures of the damage, documenting repair estimates from qualified auto body shops, and collecting contact details from the other party involved.

Effective communication with your insurance provider is crucial. Keep detailed records of all conversations, emails, and documentation sent during the process. The insurer will assign a claim number which should be used for all future correspondence. They will also provide guidance on where to take your vehicle for collision repair, suggesting trusted auto body shops specializing in car paint repair or auto frame repair as needed.

When filing a collision insurance claim, understanding your coverage, thoroughly documenting incidents, and navigating the process efficiently are key. By gathering relevant information, presenting compelling evidence, and communicating effectively with insurers, you can ensure a smoother journey towards resolution. Remember, a well-prepared collision insurance claim increases your chances of receiving fair compensation for unexpected vehicle damages.