When multiple parties are at fault for a collision, insurance companies use comparative negligence to calculate responsibility, impacting compensation for property damage, repairs, lost wages, and medical bills. Navigating these claims requires meticulous record-keeping, clear communication with insurers, and understanding the scope of damages to ensure fair settlements. Engaging professionals specializing in collision insurance claims can streamline the process.

When multiple parties are at fault in a collision, understanding joint liability becomes crucial for effective collision insurance claims resolution. This complex scenario necessitates navigating intricate legal and financial responsibilities. In this article, we explore key aspects: “Understanding Joint Fault in Collision Claims,” “Navigating Complex Liability When Multiple Parties Involved,” and “Strategies for Effective Resolution in Multi-Party Collisions.” Discover how to manage these challenges and achieve favorable outcomes.

- Understanding Joint Fault in Collision Claims

- Navigating Complex Liability When Multiple Parties Involved

- Strategies for Effective Resolution in Multi-Party Collisions

Understanding Joint Fault in Collision Claims

When it comes to collision insurance claims, understanding joint fault is crucial. In many jurisdictions, when multiple parties are at fault for a collision, each party’s insurance company will assess the percentage of responsibility attributed to them. This concept is often referred to as “comparative negligence.” The total compensation for damages is then divided among the responsible parties in proportion to their fault. For instance, if you’re involved in an automotive collision and it’s determined that both you and the other driver held some degree of blame—perhaps one was speeding while the other ran a red light—your insurance company will calculate your individual share of responsibility. This can impact not only the settlement for property damage but also any personal injury claims.

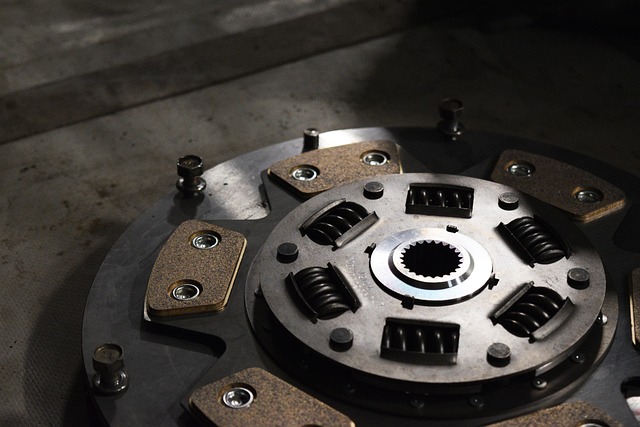

This means if you’ve incurred significant expenses for auto body repair or even auto glass repair due to the collision, your compensation may be reduced by the percentage of fault attributed to you. The same principle applies when it comes to seeking compensation for time off work and medical bills resulting from injuries sustained in the accident. It’s important to remember that understanding joint fault is essential during the claims process to ensure you receive a fair settlement, especially when multiple parties are involved. This can require meticulous record-keeping of expenses and clear communication with your insurance provider about any repairs, including automotive collision repair and auto body repair, as well as any other relevant services.

Navigating Complex Liability When Multiple Parties Involved

When multiple parties are at fault for an incident, navigating collision insurance claims becomes a complex web. Each party involved, from drivers to businesses or property owners, may bear some liability, making it crucial to understand the intricacies of responsibility distribution. This is especially true when dealing with damage to vehicle bodywork, as different factors can contribute to who is ultimately responsible for coverage and repair costs.

In these scenarios, insurance companies carefully assess the circumstances leading up to the collision. They consider factors such as negligence, liability laws, and policy terms to determine each party’s share of fault. For example, if a driver runs a red light and collides with another vehicle, their lack of attention could be deemed negligent. Auto body repair costs resulting from this accident might not be fully covered by one party’s insurance alone, as the at-fault driver typically bears the brunt of responsibility. However, other factors like weather conditions or faulty vehicle maintenance could also play a role in apportioning liability, potentially impacting collision insurance claims and the extent of auto body repair services required.

Strategies for Effective Resolution in Multi-Party Collisions

When multiple parties are at fault in a collision, navigating the insurance claims process can be complex. Effective resolution requires robust strategies tailored to multi-party scenarios. The first step is comprehensive documentation; all parties involved should meticulously record details of the incident, including damage assessments and witness statements. This foundation aids in constructing compelling arguments for each entity’s liability.

Collaboration becomes key; engaging a dedicated claims adjuster or legal professional experienced in collision insurance claims can streamline the process. They facilitate communication among all stakeholders, ensuring everyone’s interests are represented. Additionally, understanding the extent of damages—from minor car dent repairs to extensive automotive repair—is crucial. Prompt action, such as arranging for dent removal services, can preserve evidence and potentially influence settlement outcomes.

When multiple parties are at fault in a collision, understanding joint liability becomes crucial for effective resolution of insurance claims. Navigating complex liability requires strategic approaches and open communication among all involved. By employing strategies that promote transparency and mutual agreement, parties can streamline the process, reduce tensions, and achieve fair compensation for all collision insurance claims.